Subsidiaries opened in Portugal are forms of businesses which can be established by foreign companies who want to have limited liability in the company’s actions. A subsidiary registered in Portugal is considered a legal entity and can hire personnel and conclude contracts without the approval of the foreign company. The main difference between a local company and a Portuguese subsidiary is that the capital of the last one is owned partially or entirely by the foreign company. Assistance in opening a subsidiary in Portugal can be entirely provided by our company formation specialists in Portugal at any time.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Company Law in Portugal |

|

Best used for |

– banking, – insurance, – telecommunication, – IT |

|

Minimum share capital |

Yes |

| Time frame for the incorporation (approx.) |

2-4 weeks |

| Management (local/foreign) |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Yes |

| Liability of the parent company | No, the subsidiary is fully liable |

| Corporate tax rate | 21% |

| Possibility of hiring local staff | Yes |

What is the registration process of a company in Portugal in 2024?

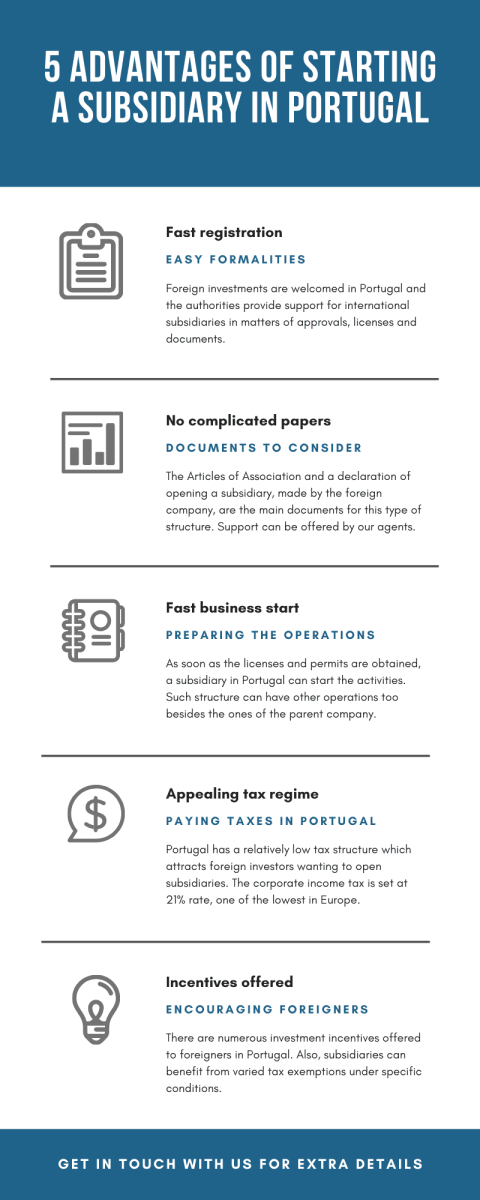

A foreign company can easily open subsidiaries in Portugal, mentioning the fact that these have the same rights and obligations as the local companies in Portugal. Below is information about the main requirements for establishing a subsidiary in this country:

- A declaration stating that the Portuguese company intends to open subsidiaries is requested by the authorities.

- Subsidiaries formed in Portugal can be registered as limited liability companies, private or public.

- The private limited liability companies (sociedade por quotas) are forms of business adopted especially by small and medium-sized companies in Portugal.

- At least two members must set up this type of business with a minimum share capital of EUR 5,000, divided into non-transferable shares.

It is important to know that the shares cannot be registered at the stock market and the liability of the members is limited by their contribution to the capital. Our agents can explain you the business requirements for Portugal in 2024.

According to the Portuguese Company Act, subsidiaries in this country should have fewer than 50 employees, combined assets not exceeding EUR 1,5 million, and revenues under EUR 3 million.

Incorporating a public LLC in Portugal

The public limited liability company in Portugal (sociedade anónima) is a form of business adopted especially by large corporations for which at least EUR 50,000 as an initial contribution and a minimum number of five shareholders are mandatory requirements in order to be incorporated. Just like in the case of the private limited liability companies in Portugal, the liability of the founders is limited to the amount of their contribution, mentioning that the shares can be registered at the stock market with freely transferable status.

Requirements for registering a company in Portugal

The registration of the Portuguese subsidiaries in the Commercial Registry is compulsory. A subsidiary established in Portugal must have a unique name, therefore, it is necessary to verify the availability of the wanted name. If the name is available, a reservation can be made by making an application in this sense. The next step refers to the registration of the Articles of Association, the foundation deeds and the decision of opening a subsidiary with the local authorities, which will grant the registration for taxes, VAT and will release the certificate of incorporation. If all the documents are properly submitted with the Company Registry in Portugal, the process of incorporation might not take longer than one day.

The following step refers to the registration with the Social Security Regional Center and a notification to the Labor Office. It is important to have the employees registered at a private insurer for the workmen’s accident compensation insurance. In the end, the entire registration process of a subsidiary in Portugal will take approximately five working days.

The registration of a subsidiary in Portugal is quite easy and some of the procedures can be done online. However, entrepreneurs who want to register such structure can be represented by one of our local specialists, with a power of attorney.

Here is a video presentation with information about subsidiaries in Portugal and the ways in which these can be registered:

Who can set up subsidiaries in Portugal in 2024?

International companies interested in having a business presence in the Iberic Peninsula and particularly in Portugal can choose the subsidiary as the proper business structure for future operations. Subsidiaries are 100% independent and can have additional activities too, separate from the ones established by the parent company in the foreign country.

Those who plan to develop some activities in Portugal are advised to ask for services offered by our accountants in Portugal. Portuguese Accounting Standards, and International Financial Reporting Standards (IFRS) are the sets of laws by which a company must be guided, in terms of accounting. We also recommend our outsourced services, instead of an entire department to benefit from advantageous prices and services.

An advisor or a specialist in company formation in Portugal can provide information about the general rules of subsidiaries established in this country. It is quite recommended to have such support by your side and benefit from assistance in terms of formation of a subsidiary in Portugal.

Is it necessary to have an appointed representative for a subsidiary in Portugal?

Yes, the foreign company and its owners must appoint a representative for the future subsidiary in Portugal, mentioning that a power of attorney is needed. To simplify and speed up the registration process without having to travel to Portugal, you can appoint one of our advisors with a POA in order to represent your company and interests in Portugal.

A bank account for a subsidiary in Portugal

Each company formed in Portugal cannot commence the activities without a local bank account. A provisionary bank account can be opened for depositing the minimum share capital of the company, and eventually can transform it into a permanent one, connected to all the financial transactions of the firm. The banking system in Portugal consists of local and foreign banks and other financial institutions which can be chosen for subsidiaries in Portugal. If you need assistance for opening a bank account for your subsidiary in Portugal, we suggest you address to our team of company incorporation agents in Portugal and solicit assistance and support.

Subsidiaries involved in taxable transactions in Portugal must be registered for the payment of VAT. This registration is made with the Tax and Customs Authority in Portugal. Besides that, take into account that specific business licenses might be required for your future operations under a subsidiary in Portugal.

Accounting requirements for subsidiaries in Portugal

From the start, one should know that the International Financial and Reporting Standards (IFRS) apply to any kind of company in Portugal, alongside the national legislation. In matters of accounting reports, the company financial statements consist of a balance sheet, the profit and loss account plus the annual financial report. The certification and auditing of companies in Portugal are normally conducted by a statutory auditor, whose actions are overseen by several bodies and authorities in the country. All the declarations and accounts must be submitted through IES or the Simplified Business Information system in Portugal.

As an additional fact, it is good to know that many subsidiaries in Portugal have outsourced accounting services instead of an entire department established in the company. If you are interested in complete accounting services for your subsidiary in Portugal in 2024, you may get in touch with our team of advisors and ask for support in this direction.

Differences between branches and subsidiaries in Portugal

The level of independence is crucial when deciding whether to choose a branch or a subsidiary in Portugal. This is the main difference between the two entities, highlighting the fact that subsidiaries are separate legal entities which can run freely from the parent company, even if the same operations are established. In the case of branches, things are quite the opposite, meaning that the foreign company is entirely liable for the debts and liabilities of the branch established in Portugal. When it comes to taxation, subsidiaries have a different status, referring to the fact that the worldwide profits will be levied compared to branches for which only the incomes derived in Portugal will be levied. Below we have gathered information and statistics that might be in the best interest of foreigners wanting to start a business in Portugal:

- the total FDI flow registered in Portugal last year was around $ 4.895 million;

- the “Startup Visa Programme” addresses to foreign investors wanting to commence new projects and companies in Portugal;

- minimum investments of EUR 350,000 can be made by foreign entrepreneurs interested in gaining the Portuguese Golden Visa;

- most foreign investments have been directed to the financial and insurance sector in Portugal, in a share of 27% rate.

- The Netherlands is the main foreign investor in Portugal.

Please feel free to contact our specialists in company formation in Portugal for more details regarding subsidiaries in this country. We can also put you in contact with our partners in Spain, if you want to open a company in this country and register for VAT in 2024.